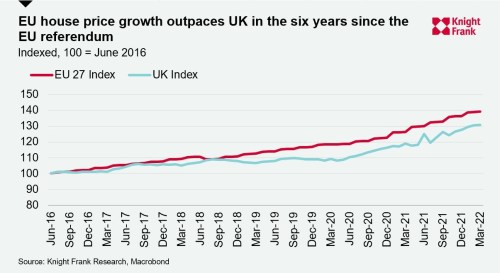

House prices have risen by 39.3% across countries in the European Union since the Brexit vote, exceeding the six-year increase of 30.8% in the UK, Knight Frank analysis shows.

Twelve of the 27 markets have witnessed price growth in excess of 50% since 2016, Germany, Ireland and Portugal amongst them.

A prolonged period of low interest rates, significant fiscal stimulus across the region during the Covid-19 crisis which led to accumulated savings and limited new supply, exacerbated by the pandemic has seen prices climb.

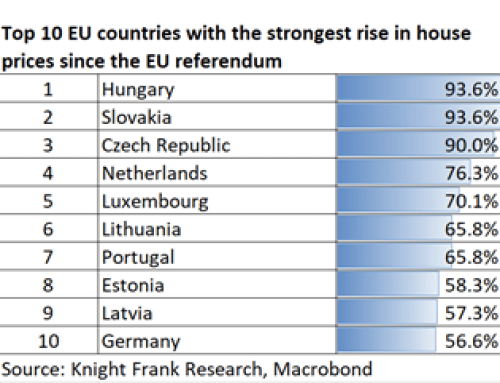

Central Europe is on top, as Hungary has seen the strongest rise in house price growth (93.6%), followed by Slovakia (93.6%) and the Czech Republic (90.0%).

As monetary policy tightens, the rate of growth across the UK and the EU is expected to slow.

Italy, Spain and Greece have recorded some of the lowest rates of price growth in the last six years and the higher cost of finance may see price growth in these markets fall into negative territory.

With the EU expected to be slower to increase interest rates – the first hike slated to be in July – and the US and UK amongst the fastest there may be a currency play for some overseas buyers looking to take advantage of a weaker euro.